does nevada tax your retirement

This is a huge benefit for individuals nearing retirement and a reason many of them are flocking to the Silver State. 2 days agoRecall from my part-two article on required minimum distributions RMDs the case study of 40-year-old couple who saved 500000 combined in pre-tax retirement accounts and.

Here Are The Most Tax Friendly States For Retirees Marketwatch Retirement Retirement Income Retirement Planning

Up to 24000 of military retirement pay is exempt for retirees age 65 and older.

. 404-417-6501 or 877-423-6177 or. Up to 3500 is exempt. What taxes do retirees pay in Nevada.

52 rows Tax info. Since Nevada does not have a state income tax any income you receive during retirement will not be taxed at the state levelThis includes income. 800-352-3671 or 850-488-6800 or.

How does nevada tax retirees. Download The 15-Minute Retirement Plan by Fisher Investments. Does Nevada have property taxes.

Retirement income exclusion from 35000 to 65000. The states average effective property tax rate is just 053 which is well below the national average of 107. By comparison Nevada does not tax any retirement income.

Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas. Ad If you have a 500000 portfolio be prepared to have enough income for your retirement. 20000 for those ages 55 to 64.

Since Nevada does not have a state income tax any income you receive during. 16 hours agoThe Gravitas Tax tool can provide an accurate picture of your tax situation while also saving you time and money. Nevada is extremely tax-friendly for retirees.

To figure out your provisional income begin with your adjusted. If you have provisional income you may have to pony up federal income tax on as much as 85 of your benefits. The cost-of-living indices for Nevada was a 1105.

Since Nevada does not have a. Its a key tool in a financial planners toolbox to help clients. Nine of those states that dont tax retirement plan income simply have no state income taxes at all.

37 States That Don T Tax Social Security Benefits The Motley Fool

Here Are The 10 Best Cities In Nevada To Retire In Best Cities Best Places To Retire Nevada

Map Here Are The Best And Worst U S States For Retirement In 2020

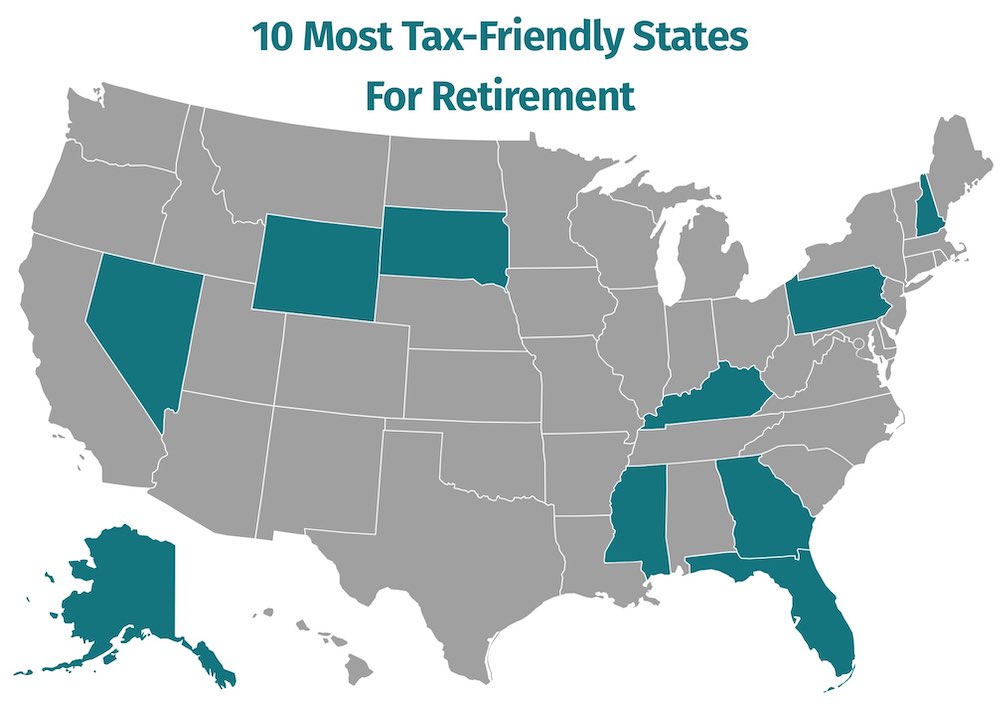

10 Most Tax Friendly States For Retirees Retirement Locations Retirement Tax

Top 10 Most Tax Friendly States For Retirement 2021

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

Tax Friendly States For Retirees Best Places To Pay The Least

7 States That Do Not Tax Retirement Income

Monday Map State Income Taxes On Social Security Benefits Social Security Benefits Map Social Security

Got The Tax Day Blues Enjoy This Fun Infographic About Everyone S Favorite Holiday Tax Season Humor Taxes Humor Tax Day

There Are 9 Us States With No Income Tax But 2 Of Them Still Taxed Investment Earnings In 2020 Income Tax Income Tax

The Most Tax Friendly U S State For Retirees Isn T What You D Guess And Neither Is The Least Tax Friendly Market Inheritance Tax Retirement Strategies Tax

Map The Most And Least Tax Friendly States Yahoo Finance Best Places To Retire Map Life Map

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Dakota 5 T Retirement Retirement Income Retirement Locations

States That Don T Tax Retirement Income Personal Capital

Tax Friendly States For Retirees Best Places To Pay The Least

Taxes The Most And Least Friendly States For Retirees Pictures Of The Week National Parks Furnace Creek